Digital advertising showed no signs of slowing in 2023, with global spending reaching an estimated $423.3 billion — accounting for approximately $3 in every $5 spent on ads worldwide.

But who’s spending all that money, and how are they spending it?

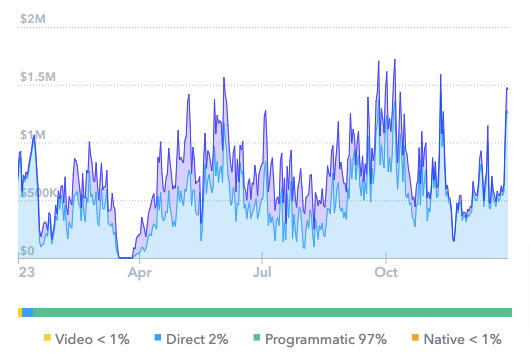

To answer those questions, we analyzed exclusive Adbeat data to identify the 10 biggest display advertisers in the US in 2023, representing a combined $4.6 billion+ of spending on video, direct, programmatic, and native ads throughout the year.

Here’s what we found:

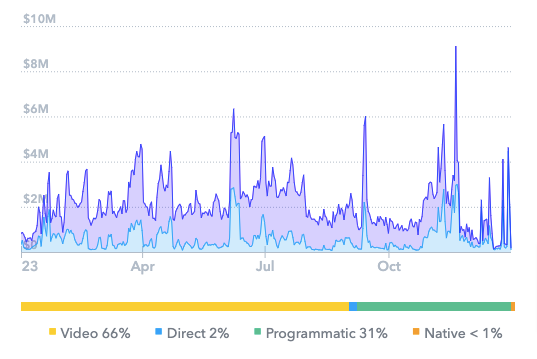

1. Apple: Total spend $775m

Apple retained its position as America’s top-spending display advertiser in 2023, dropping an estimated $9.1 million on a single day on November 20 (although its total spending actually declined by just over 2.5% year on year).

Two-thirds of its outlay, or just under $512 million, was spent on YouTube ads:

Its biggest ad — an introduction to the Apple Vision Pro mixed reality headset — accounted for a cool $21.4 million of spending and notched up 1.7 billion impressions in the single week it was live, from June 5 – 12:

When you think about it, this makes total sense:

Apple has forged a reputation for innovative, beautiful product design — and video ads are the best way to showcase these qualities.

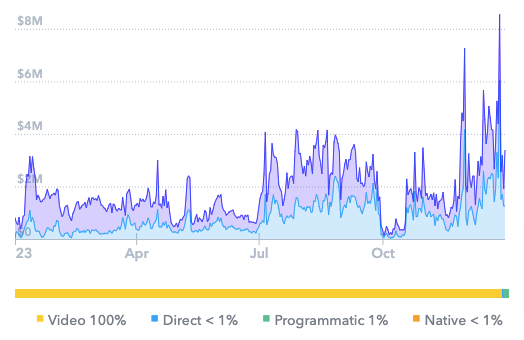

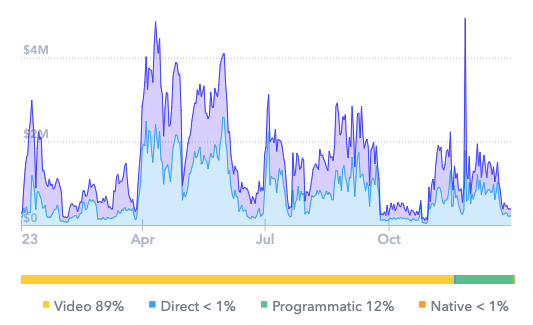

2. State Farm: Total spend $668.6m

State Farm near-doubled its display advertising spend year on year in 2023, with the overwhelming majority of its ad budget going to YouTube:

Digging into State Farm’s top ads by spend, we can see a clear divide between business-as-usual activity and short-term campaigns.

Throughout the year, the bulk of its budget went toward various six-second video ads featuring the tagline: “TFW you get affordable insurance.”

This one, for example, accounted for $80 million in spending and generated 3.4 billion impressions.

When that creative started to get tired, State Farm swapped it out for a different variant.

This pattern continued until the end of Q4, when the advertiser bet big on two celebrity ads — one featuring Jimmy Fallon and the other starring Ludacris:

The latter finished the year as State Farm’s seventh biggest ad by spend, despite only debuting on November 24.

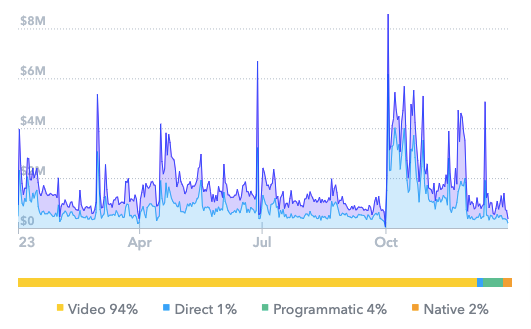

3. Verizon: Total spend $607.4m

Verizon slipped from being America’s second biggest display advertiser in 2022 to third place in 2023, with its ad spend dipping by just over 2% year on year.

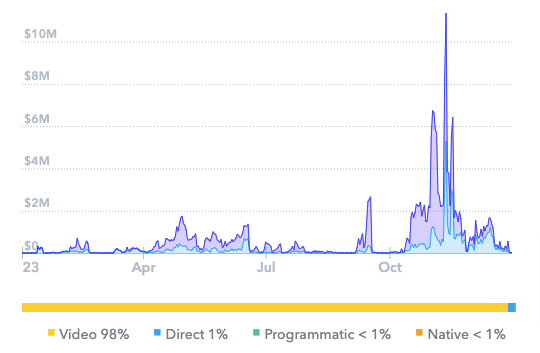

Interestingly, one-fifth of its total budget was spent in October, including $8.6 million on October 3 alone:

Of course, this didn’t happen by chance. Apple dropped the iPhone 15 Pro in late September, with Verizon’s top two ads focusing on the new device.

In fact, four of the brand’s 10 top ads of 2023 were centered on new Apple devices, with its single biggest ad — a promo for the iPhone 15 Pro, featuring actors Jason Bateman and Sean Hayes — racking up 3.8 billion impressions and $94.2 million in spend between October 2 and December 8:

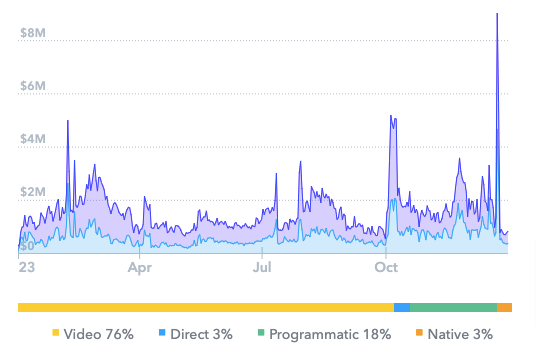

4. Amazon: Total spend $573.3m

Amazon slipped a place in our ranking of top-spending US display advertisers, from third in 2022 to fourth in 2023 — although its total spend actually increased by 13% year on year.

The e-commerce giant’s spending was spread pretty consistently throughout the year, barring a major spike on December 23:

In fact, Amazon’s single biggest ad of the year only ran from December 22 – 24, during which time it attracted $12.3 million in spending and over 683 million impressions:

We know what you’re thinking: “Why would an online marketplace drop all that money two days before Christmas?”

It all speaks to the breadth of Amazon’s service offering.

For starters, Amazon Prime offers the option of next-day — or even same-day — delivery, making it a life-saver for last-minute Christmas shoppers.

And there’s also the streaming element; a key differentiator given Amazon’s investment in original, festive content like Candy Cane Lane and Your Christmas or Mine?.

5. Walmart: Total spend $550m

Walmart was one of the biggest climbers in the 2023 digital ad spending stakes, with its total spend increasing by a staggering 117% year on year.

As with almost all the top advertisers in our ranking, the lion’s share of Walmart’s digital ad budget was focused on YouTube:

What makes Walmart stand out against many of its competitors is its commitment to constant iteration and testing of different ad creatives.

No fewer than five of its ads attracted at least $30 million in spend, yet none had a budget of more than $40.2 million.

That’s because the retailer consistently chopped and changed creatives, with its single biggest ad by spend only running for a month, from August 22 to September 24.

That’s a smart play.

The more you test, the better you understand what works for your audience.

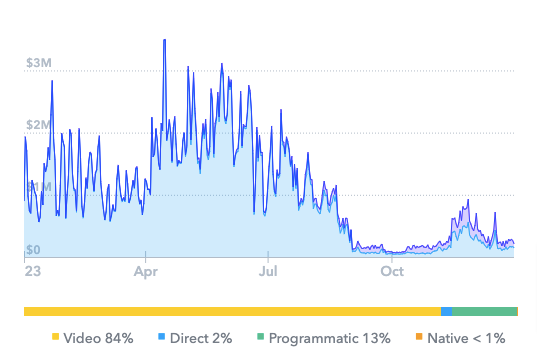

6. Adobe: Total spend $392.2m

There’s no other way to describe it: Adobe went buck wild for digital ads in 2023, increasing its annual spend by almost 250% year on year.

However, as you can see, their spend was far from consistent — slumping from $68.4 million in May to just $27.6 million in the whole of Q4:

What the heck? Did they lose their Google Ad Manager login in October?

We’ve no idea. What we can tell you is that four of Adobe’s five top ads by spend in 2023 were for Acrobat, its family of app software and web services — with its single-biggest ad accounting for over $70 million in spend and generating an estimated 5.5 billion impressions before being switched off in June:

Traditionally, search activity around Adobe Acrobat slows toward the end of the year, so we guess this is simply a case of Adobe understanding the seasonality of its products.

7. Wendy’s: Total spend $305.8m

Wendy’s was another advertiser to boost its digital ad spending, from $279.7 million in 2022 to over $305 million in 2023 — an increase of almost 10%.

Once again, almost all of that budget was dedicated to a single network: YouTube. That’s not surprising given that video now represents approximately one-third of all display ad spend worldwide.

The fast-casual dining chain was more than happy to experiment with landing pages in 2023, with four variants attracting between $20.4 million and $23.5 million in spending.

Some of those landing pages were for general campaigns promoting the company’s online delivery service, while others were targeted at a single item on the Wendy’s menu (like french fries) or a specific meal, like breakfast:

Just like with Walmart, Wendy’s approach (or should that be Wendy’s’? Wendy’s’s?) speaks to the benefits of constant testing to understand which creatives, messaging, and landing pages play best with your audience.

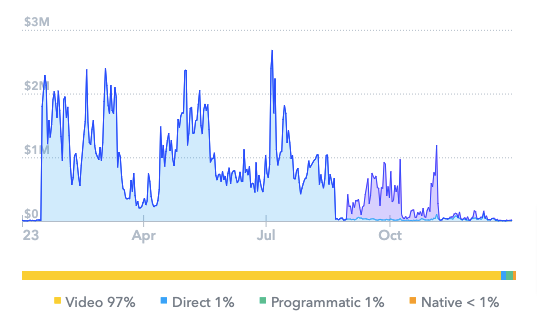

8. Grammarly: Total spend $260.9m

Grammarly’s digital ad spend declined by 12% year on year in 2023, but the AI-powered writing assist remained one of America’s top advertisers.

Its spending patterns echoed those of Adobe, the other big software platform to make our top 10, with its activity dropping off a cliff in the second half of the year:

Seems that people make the bulk of their software purchases in the first half of the year.

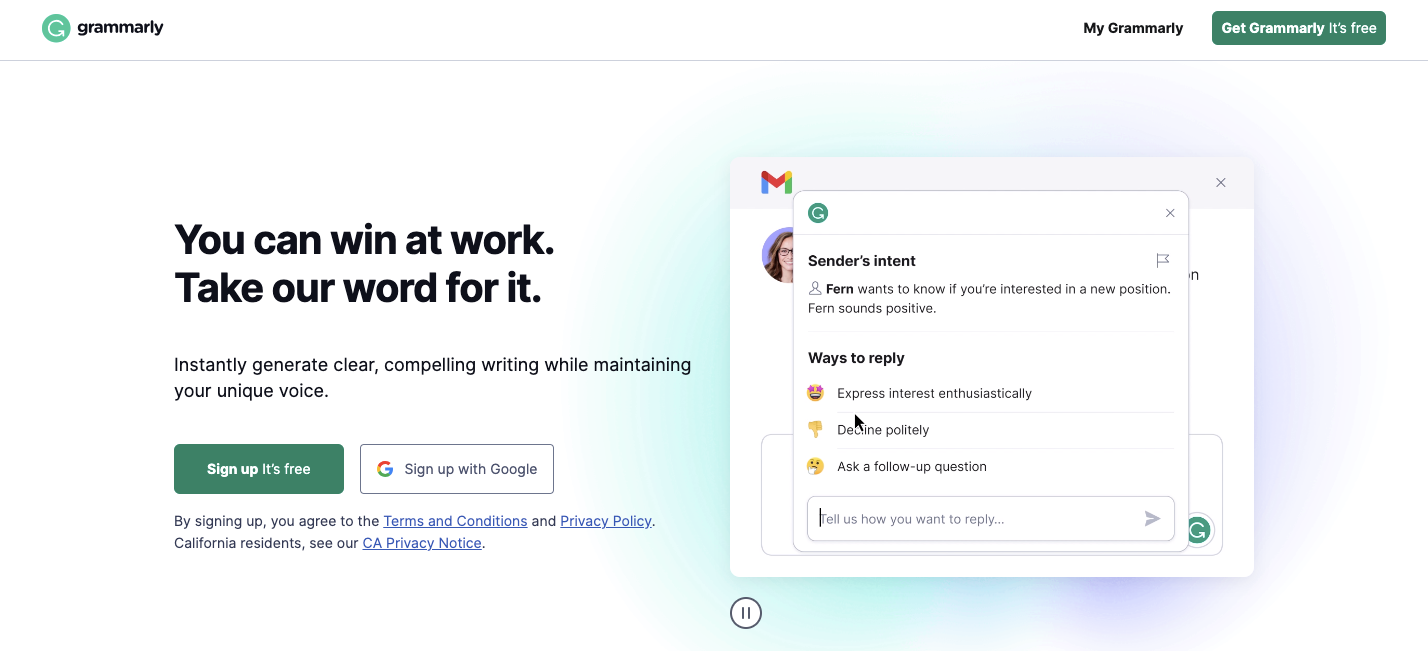

Grammarly’s landing pages are some of the best we’ve seen, so let’s (briefly) analyze its top-performing example, which saw $24.2 million of spend and 1.9 billion impressions throughout the year.

We love how it clearly spells out the product’s features and benefits in the headline and intro copy:

The calls to action are simple, persuasive, and promise a low-friction experience for the user:

And if you’re still not convinced, there’s plenty of social proof in the form of customer testimonials and recommendations from high-profile publications:

We’d strongly recommend taking the time to look at some of Grammarly’s landing pages yourself, especially if you’re in the software niche.

9. Temu: Total spend $257.9m

Temu only launched in the US in September 2022, yet it’s already broken into our top 10.

Beyond its short lifespan, there’s another factor that makes Temu unique among America’s top advertisers: its heavy investment in programmatic.

In fact, Temu is the only brand on our list not to spend the vast majority of its ad budget on YouTube.

With Google DV360 as its top network, the online marketplace’s spending is spread between a who’s who of big-name publishers, including Yahoo, Weather.com, and AOL — each of which accounted for at least $11 million in ad spend.

Its ads are similar to Wish.com’s, typically featuring a random selection of products (and some slightly clunky ad copy) alongside the Temu branding:

But they evidently work, with the marketplace notching up hundreds of millions of dollars in sales every month in the US.

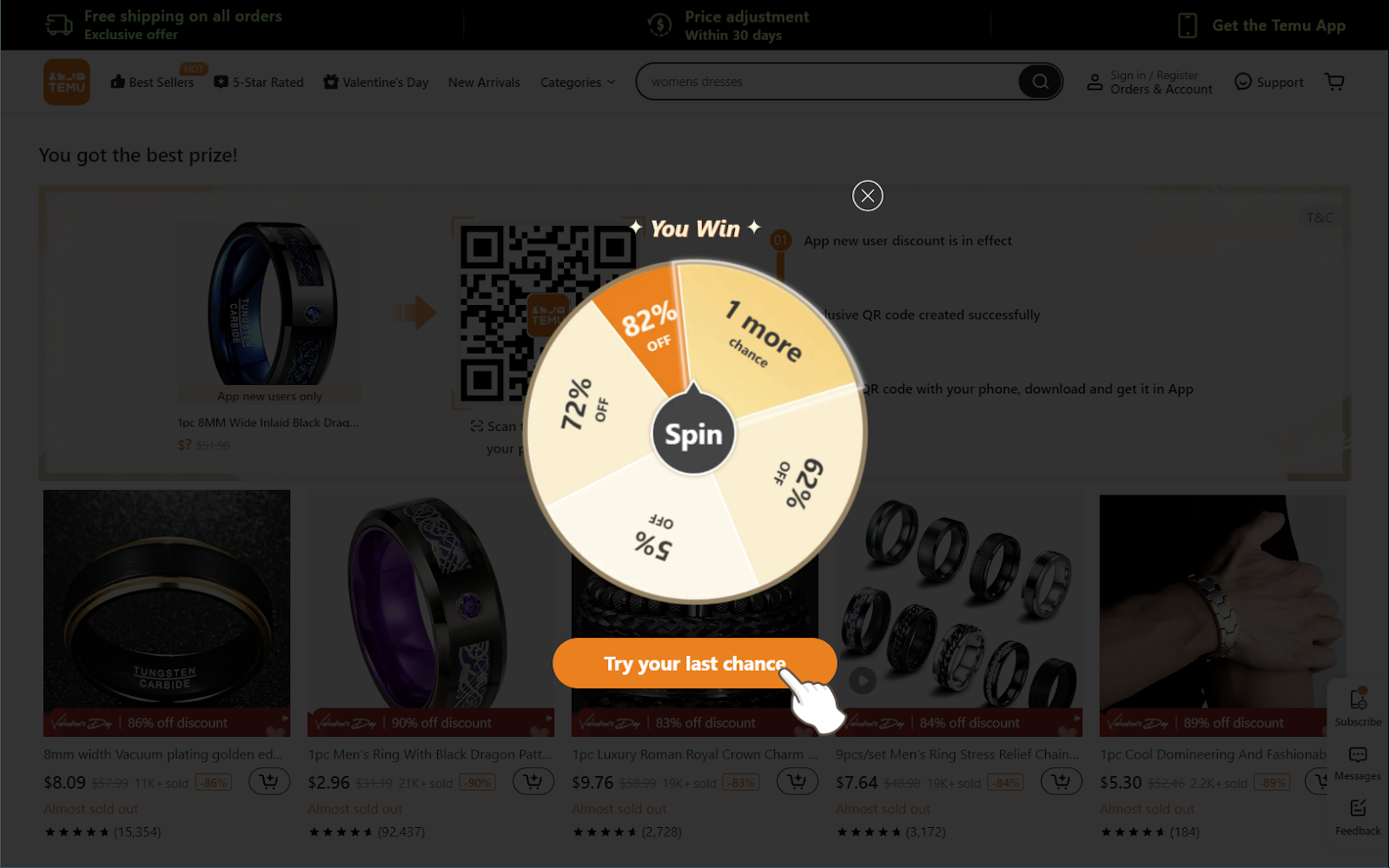

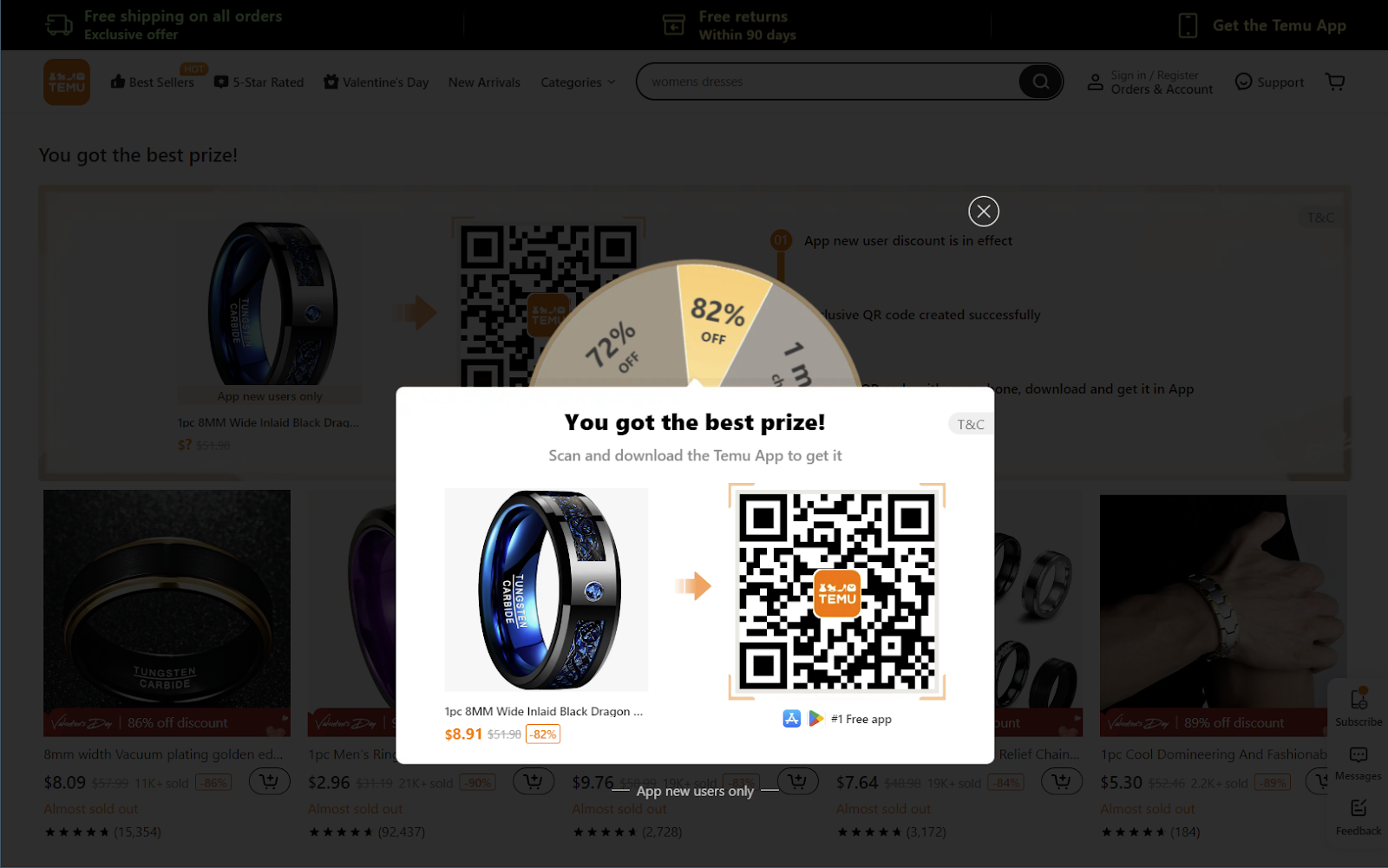

While we’re here, it’s worth briefly discussing Temu’s landing pages, many of which leverage gamification — like a “wheel of fortune” spinner — to drive conversions:

This particular version was geared toward incentivizing app downloads…

…but we’ve seen other versions using the same wheel to promote a “prize” of six free items when you purchase a single product.

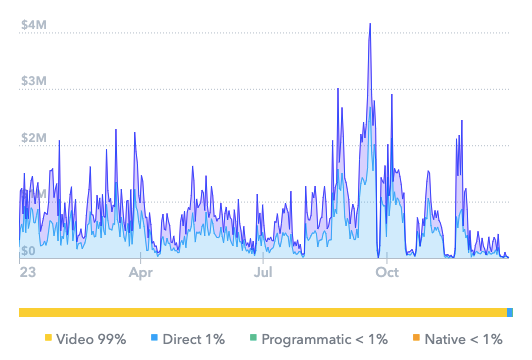

10. Disney: Total spend $235.7m

Last but not least is our biggest climber of all, Disney.

In 2022, the company spent a paltry $4.1 million on video, direct, programmatic, and native ads. Fast forward to 2023 and that amount had increased by an astonishing 5,649%.

Disney’s ad spend was heavily skewed toward the back end of the year. Q4 accounted for two-thirds of its budget, while two-fifths came in November alone.

That’s because its latest movie, Wish, came out on November 22. Indeed, seven of Disney’s 10 biggest ads of 2023 promoted the animated musical — including its top ad, which attracted $39.1 million of spending and generated 1.6 billion impressions.

Final thoughts

We saw record display ad spending in 2023, and we’re expecting more of the same in 2024.

Indeed, ad network Dentsu has predicted a 6.5% uptick in global budgets this year, which would take total expenditure to $442.6 billion.

Will the likes of Apple, State Farm, and Verizon still make up the bulk of US spending? Will Temu continue its all-out assault on the American market? Will we see a bunch of new entrants in the top 10?

There are only two ways to find out: wait for our 2024 roundup, or sign up for your own Adbeat account to get unparalleled access into how real advertisers are splashing their cash. Request your live Adbeat demo here.