With the advent of virtual reality, artificial intelligence, and chatbots in recent years, email might seem like an outdated medium for marketing. However, nearly three-quarters of businesses everywhere continue to invest email marketing to increase engagement (22%) and retain their existing customers (29%).

Out of the several email marketing services available in the marketing, Mailchimp, and Sendgrid stand out as the most popular choices for managing contacts and segmenting users to creating highly engaging emails and tracking campaign performance.

Today, we’re going to compare the two services in terms of their ad spend, landing pages, creatives and publishers to get a comprehensive understanding of they run their paid advertising campaigns.

Mailchimp

Launched in 2001, Mailchimp was designed for small businesses looking to scale as an alternative to the high-end, oversized, and expensive tools and resources. While the founders—Ben Chestnut and Dan Kurzius—started the company as an email marketing solution, they eventually expanded to offer other services including Google ads, landing pages, signup forms, and more.

In 2016, the platform was clocking in annual revenue of $400,000,000 with just 550 employees and increased their user base from 12 million to 16 million.

Despite their extraordinary growth, MailChimp’s success didn’t wasn’t an overnight affair. They’ve spent years experimenting and testing to create a practical, loveable, result-oriented product that caters to the millions of people across the globe.

Let’s take an in-depth look at how paid advertising has contributed to their progress:

Ad Spend and Ad Networks

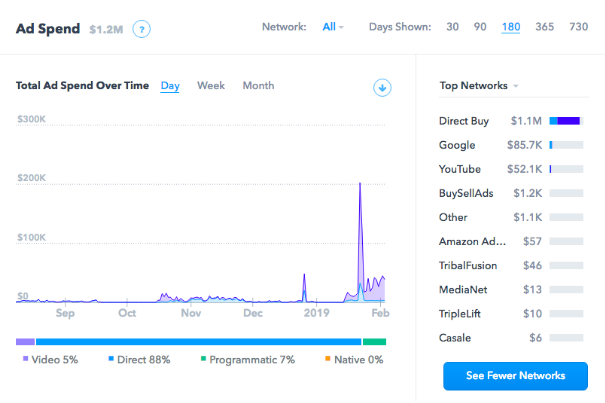

In the last 6 months, Mailchimp has spent almost $1.2 M on ads, with $1.1M going towards Display ads alone. Most businesses—big or small—like to kick off the new year by investing in new technologies and tools, which explains the sudden increase in the ad spend for Jan’19 ($644.3K). Additionally, a considerable amount of their ad spend is also allocated to Google ($85.7K) and YouTube ($52.1K).

There’s little to no money going towards Native or Programmatic advertising, which confirms Mailchimp’s preference for direct buying as opposed to real-time bidding. What does that mean, you ask? Well, in layman terms, Mailchimp buys ad impressions in bulk from specific publishers instead of auctioning each impression off to the highest bidder.

Publishers

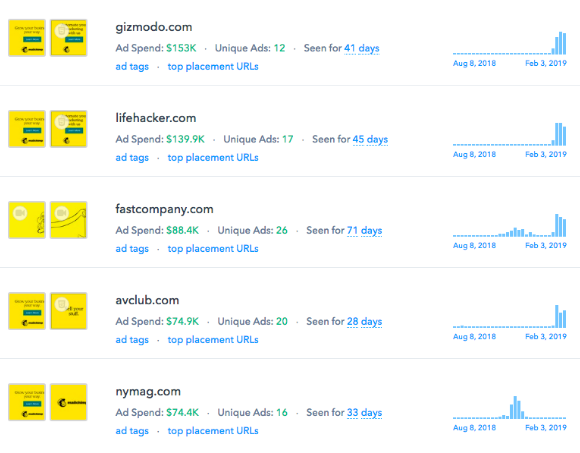

Adopting a more contextual targeting strategy, Mailchimp mostly advertises on platforms that primarily cover technology-related news. For example, their top 5 publishers include Gizmodo, Lifehacker, Fast Company, The A.V. Club and New York Magazine. As a result, their ads can usually be seen next to articles talking about the latest smart home devices, upcoming innovations, and workplace productivity hacks.

They’re also moving away from publishers like mmafighting.com, thesaurus.com, dictionary.com, The Weather Network, ESPN, Rotten Tomatoes, and more, as they are not likely to generate relevant traffic for Mailchimp.

Unlike their competitor, Mailchimp only started advertising proactively in 2018, which explains why they still appear to be experimenting with a mixed bunch of publishers. While they seem to have found a strong footing with their current publishers, in addition to other well-known platforms such as Vox, The Verge, Jezebel, Deadspin, and Vice, it would be interesting to see how they budget their ad spend in the coming months.

In the last 30 days, they’ve pitched in a significant amount of money on publishers they’ve discovered very recently— Gizmodo($153K), Lifehacker ($139.9K), and The A.V. Club ($74.9K). In the long-term, they probably benefit more from not putting all their eggs in one basket and strategically investing in new as well as old publishers that have worked well for them in the past.

Creatives

In August 2018, Mailchimp announced a complete rebrand and introduced a variety of marketing automation features for small businesses looking to sustainably scale up. Therefore, most of their recent ad creatives, including images, GIFs and videos, focus on establishing Mailchimp’s USP as ‘more than just email’.

The copy is conversational and to the point, so that an average customer can easily gauge what services Mailchimp offers. Their videos use childlike illustrations that are purposefully off-kilter to showcase the various optimization tools that Mailchimp has to offer.

The yellow paired with black, albeit a very non-web platform choice, remains consistent across all their branding collateral which is important for building recognition. Earlier, Mailchimp’s did not have a distinctive colour scheme—in fact, most of their ads last year incorporated different colours as shown below—making it difficult to ensure brand recall.

All their ads urge the viewer to ‘learn more’ by clicking on the prominently displayed call-to-action (CTA) button. As Michael Aagaard accurately points out on Unbounce—CTAs “represent the tipping point between bounce and conversion”. While visual cues like shapes and colours are important for attracting a potential customer’s attention, ultimately, a CTA is what drives them to take action by creating a sense of urgency.

Landing Pages

For most of their campaigns, Mailchimp directs all traffic to their homepage where the headline + sub-headline is less about them and more about how they can help a potential customer’s business.

Using the correct pronouns can have a lasting impact on how responsive customers are towards your marketing messages. It’s crucial that your landing page copy “speaks to your target audience and not at them.”

While writing copy for your marketing campaign, pay attention to the number of times you include the words ‘you’ vs. ‘we’. Mailchimp hits the nail on the head by using second person pronouns in almost 80% of their copy and dedicating only 20% to the first person pronouns. By focusing on the customer and their business, they’re able to personalize the landing page and the product they’re selling.

In addition to compelling, customer-centric copy, Mailchimp’s homepage also includes a personalized CTA button (that convert 42% more visitors) that encourages people to sign up for free.

Whether you want the users to subscribe to your newsletter, visit your blog, or download an e-book—a CTA is important for guiding them to the next stage of your sales funnel.

Sendgrid

Founded by Isaac Saladana, Jose Lopez, and Tim Jenkins in 2009, Sendgrid to simplify email delivery for businesses, primarily focussing on shipping notifications, newsletter, friend requests, and sign-up confirmations. Since then, the company has evolved to provide ISP monitoring, feedback loops, push notifications, SMS, domain keys, and sender policy framework (SPF).

In 2017, Sendgrid generated $111.9 million in revenue (a 40% increase from the previous year), with $15 million coming from marketing campaigns alone. Additionally, the company announced that they were processing 36 billion emails per month.

In 2018, they were acquired by Twilio, a California based cloud communications platform.

Here’s a closer look into their advertising strategy:

Ad Spend and Ad Networks

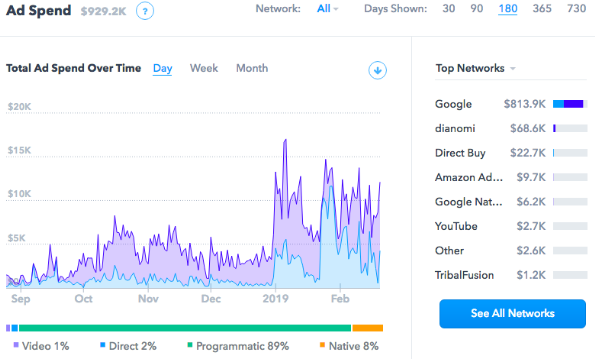

Sengrid has spent a modest $929.2K on ad campaigns in the last 6 months, with the majority being dedicated to Google ($813.9K) and only $22.7K going towards Display ads. Unlike Mailchimp, Sendgrid has remained pretty consistent with their advertising during this time—with the exception of a notable spike starting 2019. One can assume that ads on the desktop have yielded better results for them as opposed to mobile, which explains why they continue to invest more money into the former than the latter.

Sendgrid is one of the many businesses actively using programmatic technologies for advertising—a trend that’s expected to influence 65% of digital media this year. Programmatic ad-buying account for a whopping 89% of their ad spend.

Publishers

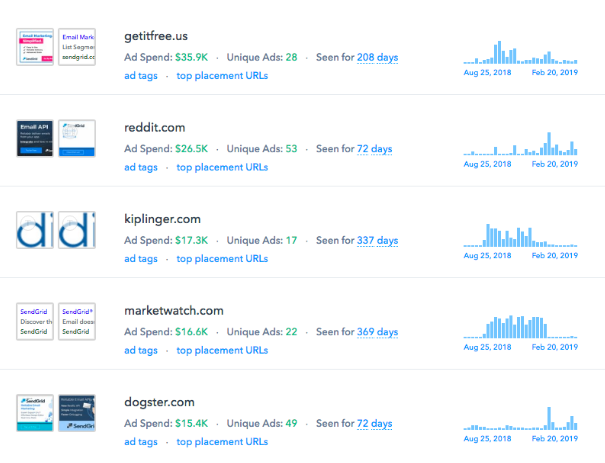

Taking a slightly unconventional approach, Sendgrid’s mostly advertisers on platforms that are not directly related to their product domain or brand values. For example, one of their top 5 publishers includes getitfree.us a website that collates the latest offers and deals. Similarly, MarketWatch and Kiplinger are about personal finance and business forecasting; Dogster is a magazine about—well, dogs; and Reddit is a user-driven community that covers pretty every topic under the sun.

In the past year, they’ve experimented with several other publishers including Social Blade, wikiHow, Nicki Swift, Racked and Deviantart—some of which they continue to advertise with.

However, they’re strategic with the spending and don’t seem to be putting a significant amount of their money on new—or any advertisers. In fact, contrary to Mailchimp that has spent $254.6K in the last 365 days on their current top publisher (Gizmodo), getitfree.us—Sendgrid’s current and overall top publisher made only $41.8K.

Creatives

In the last 6 months, Sendgrid has invested in a diverse set of ad campaigns.

For example, the following campaigns focus on improving deliverability and dynamic email templates—both of which are key USPs or selling points of the product.

They often leverage seasonal events like the holidays or their Twilio acquisition (Oct 2018) to engage with their potential audience.

Some of their advertising campaigns are also designed to promote content on the Sendgrid blog and resource section. For example, the following ads direct traffic to Be an Email Superhero: 8 Ways to Beat Your 2018 Email Goals Right Now and Your Guide to Email A/B Testing and Optimizing Your Call to Action.

Creating meaningful content for your customers establishes you as an expert in the industry, improves your SEO and in turn, contributes to lead generation.

Overall, Sendgrid frequently experiments with their ad creatives—something Mailchimp can do more of. Additionally, they opt for a clear design, a compelling CTA, and noticeable branding in all their creatives, while the aesthetic features (like, background colour, logo placement, etc) and messaging changes constantly.

Even though more than 75% of “advertising impact is determined by creative quality”, brands tend to focus more on ad targeting and placement. Implementing an A/B test is the best way to find out exactly the kind of creatives works for different audiences.

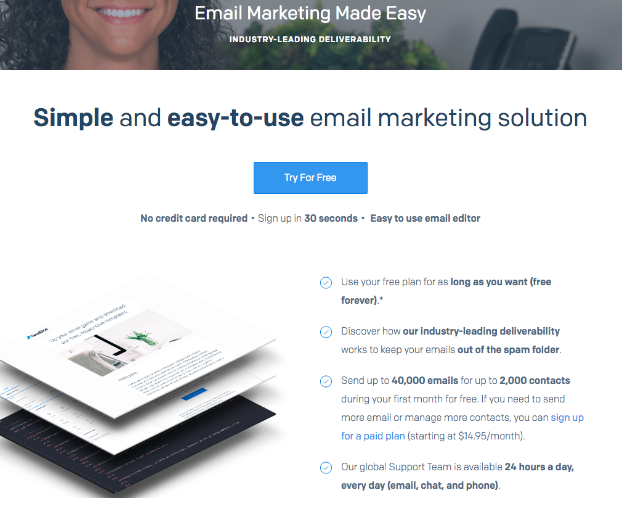

Landing Pages

Most of Sendgrid’s ad campaigns lead to the landing page below that includes an eye-catching illustration, data-driven copy that outlines their USPs, and a compelling CTA.

Conclusion

In terms of website traffic, Mailchimp globally ranks 330, whereas Sendgrid is currently at 11,510. With over $600 million in annual revenue, Mailchimp has doubled its valuation (to $4.2 billion) in the last 2 years. On the other hand, Sendgrid clocked in an estimated revenue of $97.8 million in 2018.

Clearly, Mailchimp is more popular at the moment, however, Sendgrid isn’t too fair behind either. We’ll most likely be noticing an increased spend from both of them companies as the year goes on.