Advertising on top-tier publishers like the New York Times or the Associated Press can be a mixed bag for advertisers. On the one hand, if your campaigns work, the amount of quality traffic these sites generate can make for some big wins. On the other hand, if your campaigns fail, the lost ad dollars can be hard to swallow.

These top-tier sites command higher advertising costs than most small advertisers are used to. For example, Forbes has their minimum display advertising budget set at $500. For Run-of-Site campaigns (where your ads can appear on any and all pages of their site) they want a $10 CPM. For more targeted campaigns (channel targeting or geo-targeting) you’ll have to cough up a $15 CPM.

To buy a single ad in the business section of LA Times, you need to spend as much as $1,080. Moreover, you’ll need to commit to 100,000 impressions over seven days—at a minimum.

At these prices, getting enough traffic and stats to accurately determine if your campaigns are working is going to be expensive. So much so, that a lot of smaller advertisers are going to be scared off.

But what if you could test these top tier publishers for less?

In this post, we’re going to explain how to do just that.

The Basic Concept

Here’s the basic idea: since it costs too much to buy direct, we’re going to buy through an ad network and save some money.

While this method won’t work for every publisher, it will work for a lot of them. That’s because the vast majority of these top-tier publishers serve a portion of the ads they show from ad networks.

If we’re able to buy our ads through an ad network we’ll be able to access almost the same inventory for less money. CPC bids on an ad network will be cheaper than going direct; and the minimum campaign budgets ad networks require is usually much lower.

Now before we get started, there can be a couple of hiccups to this approach:

First, ad networks typically only support standard banner sizes. (Think: 300×250, 336×280, etc.) That means you won’t be able to test more exotic formats like page-takeovers via an ad network. For that, you’d still need to go direct.

You should also keep in mind that ad network ads have lower priority when compared to Direct Buy ads. In other words, the publisher might only show ad network ads if they don’t have a direct buy contract. This can make it difficult for you to run a campaign at a specific time of day. If that time-slot is being taken-up by a direct buy advertiser, his ads get priority so your ads won’t get shown.

For most people neither of these are deal-breakers.

Getting Started

In this section we’ll cover two different ways to get started with this strategy.

As you read this, keep in mind: we’re using the Google Display Network in our example because it’s by far the most popular. However, you can use these same basic techniques with many other ad networks.

1. Determine if the Publisher is Using the Google Display Network

A simple way to check if the site is using Google display is to check the website itself. Any banners that are being run on Google display will have the Google Display Network badge in the corner.

Here’s how this icon looks like. [Image Source: forbes.com]

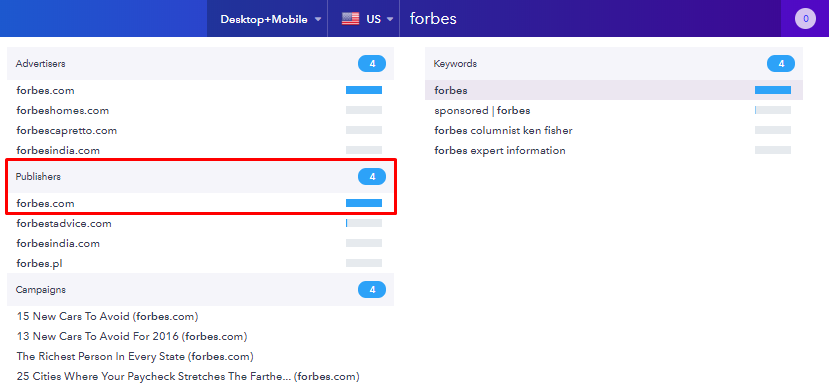

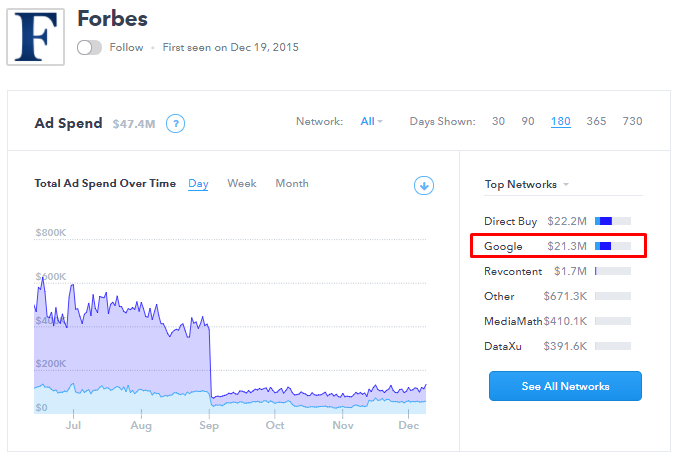

You can also use Adbeat to see what ad networks the selected site partners with, and if Google Display is among them.

CTA: Adbeat is a tool that allows you to find out what networks any website partners with. Moreover, Adbeat can show you whether your competitors use websites on which you decide to launch your ad campaigns. Try it for free now!

Let’s imagine that we need to know what networks the Forbes website is working with.

To do this, we enter the word “forbes” in the search and open Adbeat publisher profile:

Immediately after that, you will see a complete list of all the networks that partner with the Forbes website. Google Display is among them, bingo!

This means that you can run a test campaign on Forbes using the Google Display Network.

2. Create a List of Related Sites

If for whatever reason you aren’t able to run on the exact publisher site you want through an ad network (or aren’t able to get enough traffic for your test) you can try running on some related sites instead.

In order to find relevant sites for your ads, you can use different tactics.

First, you can use a free tool called Google Display Planner. It’s a great resource for generating ideas for ad placements and targeting settings.

Second, you can use your own campaign performance data.

If you have already used Google Display targeting options (interests, topics, keywords) for several weeks or months, you can check the placement report. It will show you relevant display domains and placements.

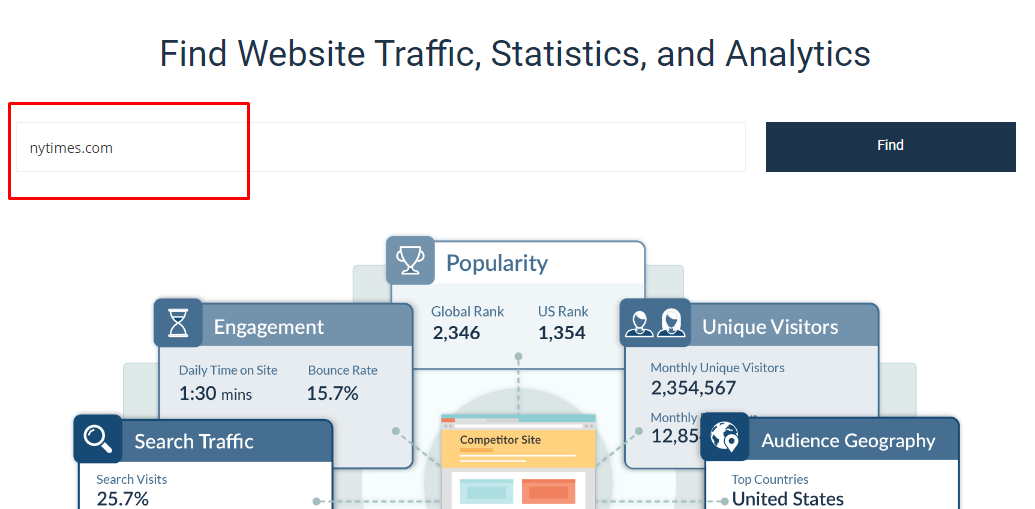

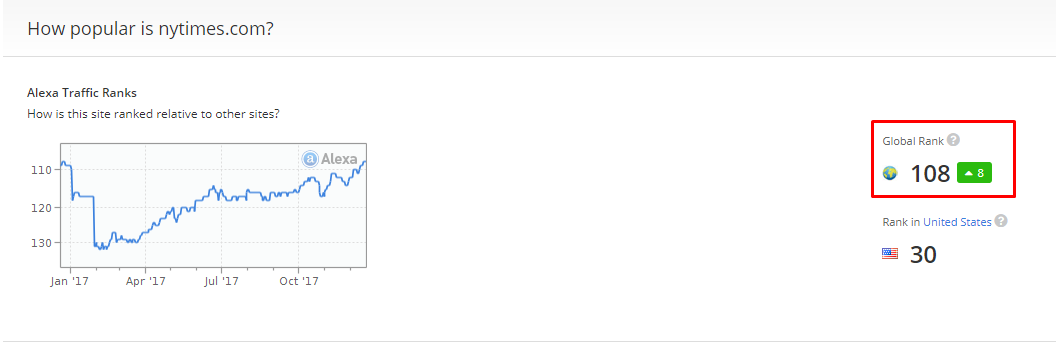

After you’ve create your list of relevant sites, you can check how much traffic each of them receives using Alexa Rank.

To do this, enter the name of the site in the Alexa search bar:

Let’s check how popular the website of “The New York Times” is.

On the next page you will see its global traffic rank:

The smaller this number, the more traffic the selected site receives. The New York Times’ website is very popular.

You should check the Alexa Rank of every site you plan to test.

If a website ranks below 50,000, you can consider it a good candidate with a decent amount of traffic.

Running Your Campaign

When it comes to setting up a test campaign, we recommend you use a $200-$500 budget and you try to get at least 200 clicks.

It also makes sense to run several test campaigns, testing one placement per campaign. This way, it will be easier to control the performance of each placement.

After you’ve reached your budget, it’s time to analyze the results. For that, we recommend paying attention to some specific metrics:

Click-Through Rate – A low CTR can indicate that the audience of a website isn’t a good fit or that your banners need improvement.

As a reference, the “US, Europe and Worldwide Display Ad Click-Through Rates Statistics Summary” says that across all ad formats and placements normal Ad CTR is 0.05%.

Cost Per Action – This is another important indicator you should keep an eye on. The appropriate CPA will, of course, vary greatly by industry. Wordstream published some stats for average CPAs that you might want to take a look at to make sure you’re in the ballpark for your industry.

A high CPA can be a sign that the site’s traffic is just too expensive for the campaign you’re trying to run.

Conversion Rate – If you’re not sure how well your conversion rate aligns with your industry peers, this post lists the average Conversion Rate in Google Display for various industries.

Bounce Rate – Bounce rate statistics can be found by checking your Google Analytics data. For the most part, bounce rate shouldn’t be above 90%.

As Chris Boulas, an entrepreneur and marketing expert, says, “70%-90% is typically normal for display campaigns that don’t use highly sophisticated targeting parameters.”

Final Thoughts

Testing potential top tier publishers using ad network inventory is a great way to reduce a lot of the risk associated with expensive direct buys.

If you use the methods outlined above and carefully analyze the results, you should be able to get a pretty good feel for whether or not your campaign will be successful should you decide to take the plunge.

Do you test popular sites through ad networks before buying ads directly? Do you know other ways to understand if it’s worth buying ads directly on popular sites? Drop us a note in the comments!