Competitive intelligence (CI) is the process of gathering, analyzing, and distributing data about companies, products, and customers in a specific marketplace to help managers in making more informed, strategic decisions.

According to the 2018 State of Market Intelligence Report, companies monitor a diverse range of audiences, including customers, partners, direct competitors, indirect competitors, and prospects. In fact, 82% of them thoroughly track their own company as a necessary part of their CI efforts. With this attentive approach, they’re able to get a well-rounded perspective on the performance of their company in the greater marketplace.

Since competitive monitoring is often time-consuming and a drain on internal resources, it comes as no surprise that many businesses rely on multiple products and services to accelerate the process. While 58% of them employ at least one competitive intelligence software tool, 34% choose to turn to research or consulting firm for more comprehensive results.

Here’s the catch, though: A single solution will not always give you a complete picture, which explains why 39% of study respondents said that they prefer to use more than two tools to fulfill their CI-related objectives.

Given that being disruptive is pretty much the only way you can succeed in this economy, learning more about your competitors is crucial to product development and marketing. Let’s take a quick look at how you can use CI to grow your business:

How can CI be useful?

- Understand customer and marketplace expectations:

Easier to run than a marketplace scan or SWOT analysis, CI not only carries out an in-depth analysis of what your current and future competitors are up to, but also gives you an insight into why they are making major strategic decisions, settlements or investments, and how receptive the overall marketplace is to these moves.

Your competitors might be spending hundreds of dollars every year on advertising—or they’re simply relying on referral partnerships and word-of-mouth to promote their brand. When you use CI to do market research, it helps you objectively see and understand how the marketplace perceives these brands, so that you offer customers exactly what they want, and take advantage of opportunities that your competitors are overlooking.

CI relies on triangulation of data to fill specific information gaps related to pricing strategy, margins, product development pipelines, and launch timing.

For example, using CI in the pharmaceutical industry has helped save or generate millions by suspending development of ineffective drugs, forgoing unprofitable deals or licensing opportunities, and expediting the development process for new drugs based on what the competitors are doing. - Learn from your immediate competitors’ success and failures:

With CI, you can keep tabs on your competition’s ad spend, probe into the returns from their campaigns, understand useful characteristics about their target audience, and ultimately, capitalize on your learnings.

You can start by dividing your existing and prospective competitors into three broad groups:- Primary or direct competitors who have the same target audience as your brand and offers a similar product or service;

- Secondary competitors whose products or services are a high or low-end version of what your brand offers or has a similar product or service with a different target audience than your;

- Tertiary competitors who’re only tangentially related to your brand’s business model.

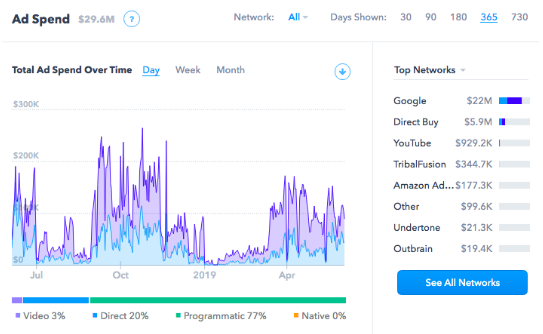

You’d be rubbing shoulders with these brands frequently and elbowing for attention in the same market—so, how do you stand your ground? Take into account the companies—including the global ones—that you admire and take a closer look at their advertising practices that you can implement easily. For example, if you’re in the music streaming space, your primary competitor will be Spotify who’ve spent a whopping $29.6M on advertising in the past year alone.

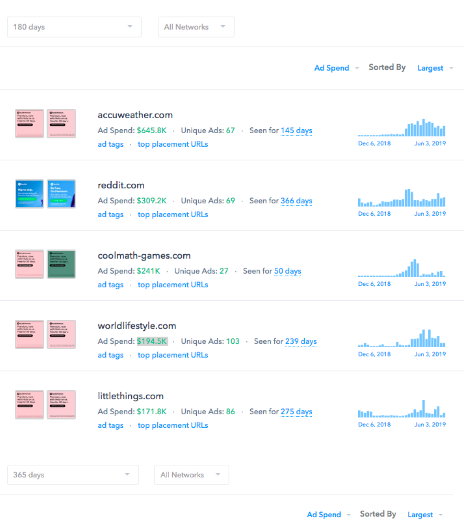

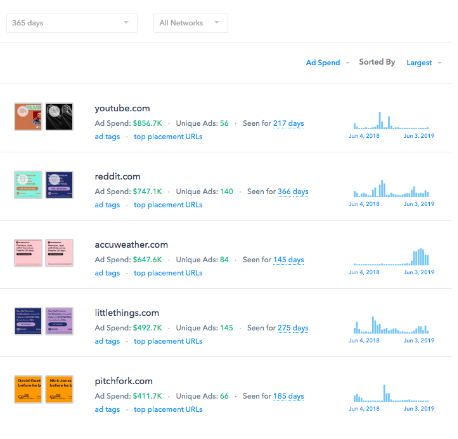

When you look at their top publishers (see below), you’ll notice that they spent substantial money ($856.7K) on Youtube, which also explains why 3 percent of their total ad spend goes towards video ads. However, in the last six months, they’ve moved away from Youtube (along with Pitchfork, another prominent publisher) and are investing their money on AccuWeather ($645.8K), World Lifestyle ($241K) and Cool Math Games ($194.5K). They’ve retained Reddit and LittleThings from last year, which they continue to dedicate a chunk of their ad spend on.

Overall, we can assume that Spotify was receiving measurable ROI by advertising on Reddit and LittleThings, but didn’t achieve the best possible outcome from Pitchfork and Youtube. As a competitor just getting into the advertising space, this information can be extremely valuable and help you shape your advertising strategy using Spotify’s successes/failures.

Many businesses lose a substantial amount of capital and pay a steep opportunity cost simply because they’re trying to get their message across channels and touchpoints that were previously viable, but are not as effective anymore. For example, if you run a company that primarily relies on trade shows to engage with prospects, using research-based CI can point you towards competitors that are getting better visibility and generating more profitable results through different strategies, like inbound marketing.

- Identify product and marketing demand gaps:

While a lot of A/B testing is required when you’re looking to get the word out for your brand, it always helps to know what’s working or not working with your competitors, so that you can learn from their failures and replicate their wins.

As a business, your primary focus is offering a strong value proposition for your product or service that meets the requirements of your prospective buyers.

CI highlights the buyer demands that your competitors are not fulfilling, as well as potential audience groups that you haven’t considered marketing to. For example, imagine you’re launching a platform where people can compare cars specifications and prices before making a purchase. Currently, with your business model, you’d be competing with the likes of Edmunds and Kelley Blue Book. In order to attract customers, you start running direct ads on various networks. While the results aren’t outstanding, you’re in a comfortable position to break even.

On a closer look at your competitors, you find that both Edmunds and Kelley Blue Book spend the entirety of their ad spend on running native ads on popular content distribution platforms like Outbrain, and Taboola. Not only this, looking at the current trends:- Native ads get 53% more views than traditional display ads.

- Native ad spending is expected to increase to $41.1 billion in 2019, accounting for 61% of overall digital display ad spending in the U.S.

Clearly, the auto industry has embraced native advertising to promote their brands, and even the buyers seem more receptive to native ads more than any other type of display ads. Now that you’ve identified a gap in your marketing strategy, you can rectify it by investing in native ads to drive more engagement and brand awareness.

Oftentimes, a company is investing a reasonable amount of local resources in a project (for example, a very high-risk R&D program) that’s not yielding positive results. By reallocating these resources to another area with actual growth potential, you’re looking at better monetary gains and faster decision-making.

In today’s fast-paced, technologically advancing world, businesses are always under pressure to enhance the way things operate and function to allow for new techniques, protocols, and materials. When you’re keeping an eye on both big and small players in the market, it’s easy to grow your company because you don’t have to reinvent the wheel and can simply adopt something from your competitor that you like.

The “something” can be marketing campaign components, customer service methods, sales strategies, advertising approach, or service delivery processes. CI makes it possible for you to learn how to position, market, distribute, and even build out the product.

That being said, it’s important to remember that CI must involve constant monitoring for it to work. You cannot come back to it occasionally, or after a competitor has stepped up their growth and expect life-changing results. After all, knowing what your competitor is about to do ahead of time can either prompt you to implement a strategic response, or at least react in a timely manner.